Category: Token Trends

-

Lutnick’s Cantor Fitzgerald Nears $4B Bitcoin Deal With Adam Back via SPAC: FT – Bitcoin News

Cantor Fitzgerald nears a $4B Bitcoin deal with Blockstream’s Adam Back via SPAC, as reported by Financial Times, marking a significant institutional crypto investment.

-

Inside Cantor Fitzgerald’s $4B Bitcoin Treasury Deal With Blockstream

Cantor Fitzgerald partners with Blockstream in a $4B Bitcoin treasury deal, contributing 30,000 BTC for equity in BSTR Holdings, signaling a major institutional Bitcoin adoption trend.

-

Cantor Fitzgerald SPAC nears $4B deal with Blockstream’s Adam Back to amass 30,000 Bitcoin

Cantor Fitzgerald’s SPAC is nearing a $4B deal with Blockstream’s Adam Back to acquire 30,000 Bitcoin, potentially becoming one of the largest institutional BTC holders.

-

Bitcoin Treasury News: Cantor Fitzgerald SPAC May Buy 30,000 BTC From Adam Back, FT Reports

Cantor Fitzgerald’s SPAC may acquire 30,000 BTC from Adam Back in a $3B+ deal, converting to BSTR Holdings and raising $800M in capital, per FT reports.

-

Cantor Fitzgerald Nears $4 Billion Bitcoin Deal With Blockstream Founder Adam Back

Cantor Fitzgerald is nearing a $4 billion SPAC deal with Blockstream founder Adam Back to acquire billions in Bitcoin, marking one of Wall Street’s largest crypto purchases to date.

-

Hypercharged Exposure to XRP and Solana Now Available With These Two ETFs – Decrypt

ProShares launched two leveraged ETFs offering double daily returns on XRP and Solana, expanding crypto investment options without direct asset ownership.

-

ProShares debuts 2x leveraged daily exposure to Solana and XRP in new ETFs

ProShares launched 2x leveraged ETFs for Solana and XRP, tracking futures contracts. These funds aim to double daily returns, expanding their crypto-linked offerings to 12 ETFs and 3 mutual funds.

-

Cantor Fitzgerald nears $4B Bitcoin deal with Blockstream’s Adam Back

Cantor Fitzgerald’s SPAC is finalizing a $4B Bitcoin deal with Blockstream’s Adam Back, acquiring 30,000 BTC and raising $800M more for crypto purchases, potentially totaling $10B in 2024.

-

Legacy finance discovers stablecoins as JPMorgan, Citigroup consider market entry

JPMorgan and Citigroup plan to enter the stablecoin market, driven by competition and regulatory progress. The GENIUS Act could legitimize stablecoins, boosting their $258B market cap.

-

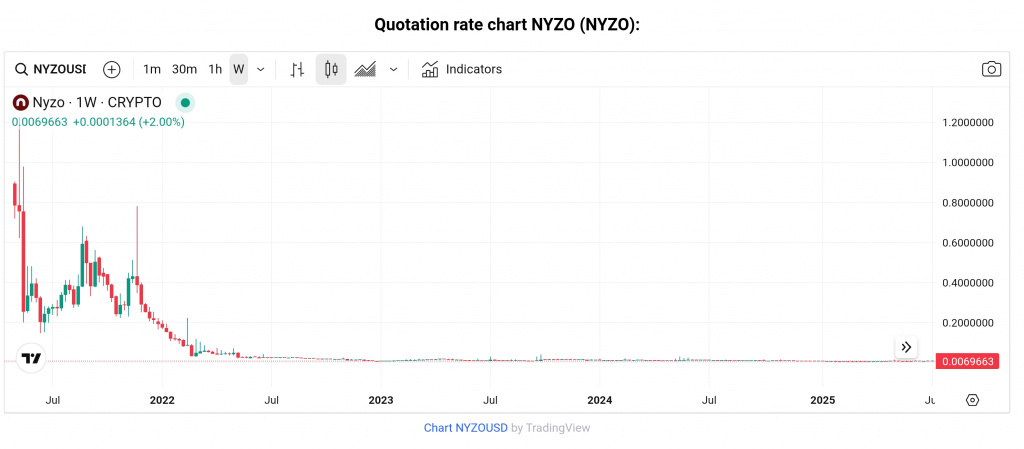

Nyzo (NYZO): Providing A Sustainable And Decentralized Blockchain Platform

Nyzo (NYZO) is a sustainable, decentralized blockchain platform using Proof-of-Diversity for security and scalability, offering energy-efficient transactions compared to traditional mechanisms.