Category: The Ledger Edge

-

Indonesia eyes Bitcoin mining for reserves

Indonesian officials consider Bitcoin mining for national reserves following a key government meeting.

-

South Korea Banks Embrace Crypto with New Laws

South Korean banks are increasingly investing in crypto as new regulations provide clearer legal frameworks for digital assets.

-

Ahmedabad Shines in India’s Web3 Scene

Ahmedabad becomes a key Web3 hub as the India Blockchain Tour arrives, showcasing blockchain innovation and community growth.

-

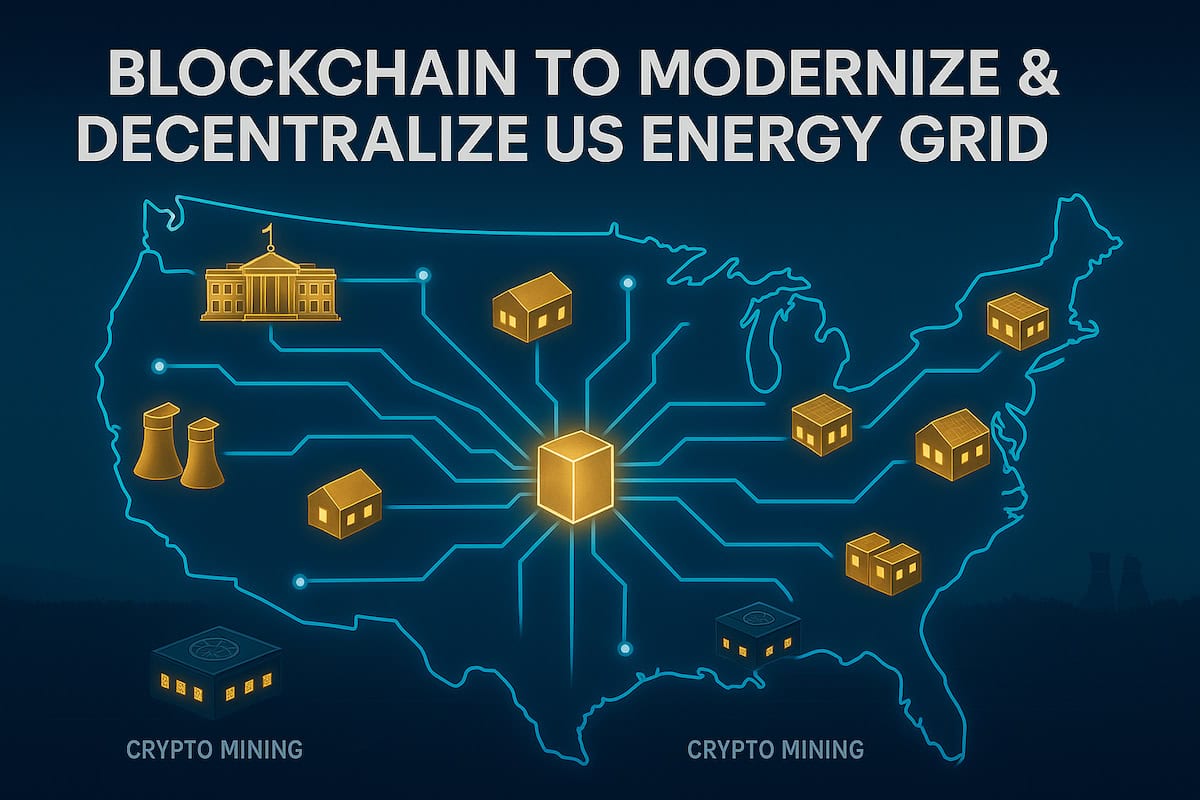

Blockchain Modernizes US Energy Grid

Blockchain technology aims to modernize and decentralize the US energy grid for efficiency and transparency.

-

B2B Digital Payments Hit $27T by 2032

B2B digital payments are projected to reach $27T by 2032, with crypto playing a key role in this growth.

-

UK Falling Behind in Crypto Race

The UK is falling behind in the global cryptocurrency competition due to regulatory challenges and lack of innovation.

-

The $100B Blockchain Takeover You Missed

How a $100 billion blockchain revolution went unnoticed by most, reshaping industries quietly.

-

Pakistan Kyrgyzstan Boost Blockchain Efforts

Pakistan and Kyrgyzstan are increasing their focus on blockchain technology to enhance digital infrastructure and economic growth.

-

Financial Officers Plan Crypto Adoption

Financial officers at major firms are planning to adopt crypto, with significant stats revealing growing corporate interest.

-

Top Countries Holding Bitcoin Secretly in 2025

Discover the top countries secretly holding Bitcoin in 2025 and their hidden crypto strategies.