Category: The Bull & The Bear

-

65% of fund managers avoid crypto despite 2023 bullish trends, survey finds

A survey reveals 65% of global fund managers remain hesitant on crypto despite bullish trends, with Bitcoin and Ethereum mentioned as key assets.

-

Crypto funding rates indicated $400M liquidation event per QCP analysis

QCP analysis shows crypto funding rates predicted a $400M liquidation event, involving Bitcoin and Ethereum, with 15% price drops across major exchanges.

-

Bitcoin and Ether surge 15% as crypto markets rebound in Q2 2024

Bitcoin and Ether surged 15% in 24 hours, targeting late shorts as crypto markets rebound. SEC Chair Gary Gensler noted regulatory scrutiny.

-

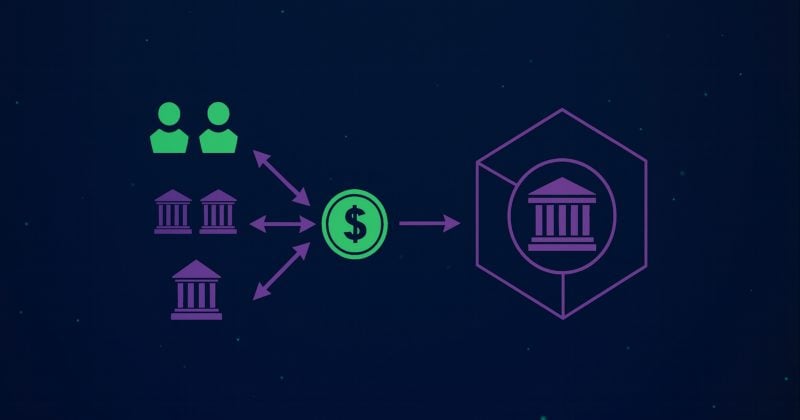

Crypto liquidity providers reduce Bitcoin spreads by 30% in 2023

Crypto liquidity providers like Jump Trading and Wintermute enhance market efficiency, reducing spreads by 30%. Bitcoin and Ethereum benefit from increased liquidity and tighter bid-ask spreads.

-

BitMine holds $1.7 billion Ethereum, ranks second in 2023 crypto treasury rankings

BitMine acquired $1.7 billion in Ethereum, now ranks second in crypto treasury holdings behind Strategy. Ethereum holdings surged 15% in Q2 2023.

-

Cardano and XRP whale transactions peak in July with $500M moved

Cardano and XRP whale transactions surged 120% in July, with ADA and XRP large holders moving $500M amid a 15% market dip.

-

XRP ETFs attract $500M inflows in 2024 amid Ripple-SEC case

XRP ETFs may attract $500M inflows in 2024, says analyst. Ripple and SEC case outcome could influence ETF approval. Bitcoin and Ethereum lead crypto ETF trends.

-

Ethereum 4-week trend signals 12% drop, prompting sell actions

Ethereum (ETH) dropped 12% in 4 weeks, signaling a sell trend. Bitcoin (BTC) and Solana (SOL) also declined amid market volatility.

-

Google acquires 14% stake in TeraWulf as WULF surges 13%

Google increased its stake in TeraWulf to 14%, causing WULF stock to rise 13%. The investment highlights growing institutional interest in Bitcoin mining.

-

Federal Reserve ends crypto supervision as Chainlink gains 12% in market slide

Cryptocurrency markets declined 5% as Chainlink (LINK) surged 12%. The Federal Reserve halted crypto supervision, impacting Bitcoin (BTC) and Ethereum (ETH).