Category: Opinion & Editorial

-

Peter Schiff calls Bitcoin ridiculously overpriced in latest critique

Peter Schiff’s criticism reflects ongoing skepticism from traditional finance figures about Bitcoin’s valuation, highlighting persistent ideological divides in investment approaches to digital assets.

-

Cryptocurrency industry must redesign incentive models for sustainable growth

Current crypto incentive models often prioritize short-term gains over sustainable growth, requiring structural changes to align long-term ecosystem health with participant rewards.

-

Miles Deutscher outlines turning $1000 into $100000 with crypto in six months

Miles Deutscher outlines a cryptocurrency investment strategy claiming potential high returns, reflecting speculative trading approaches that attract retail investors seeking rapid portfolio growth.

-

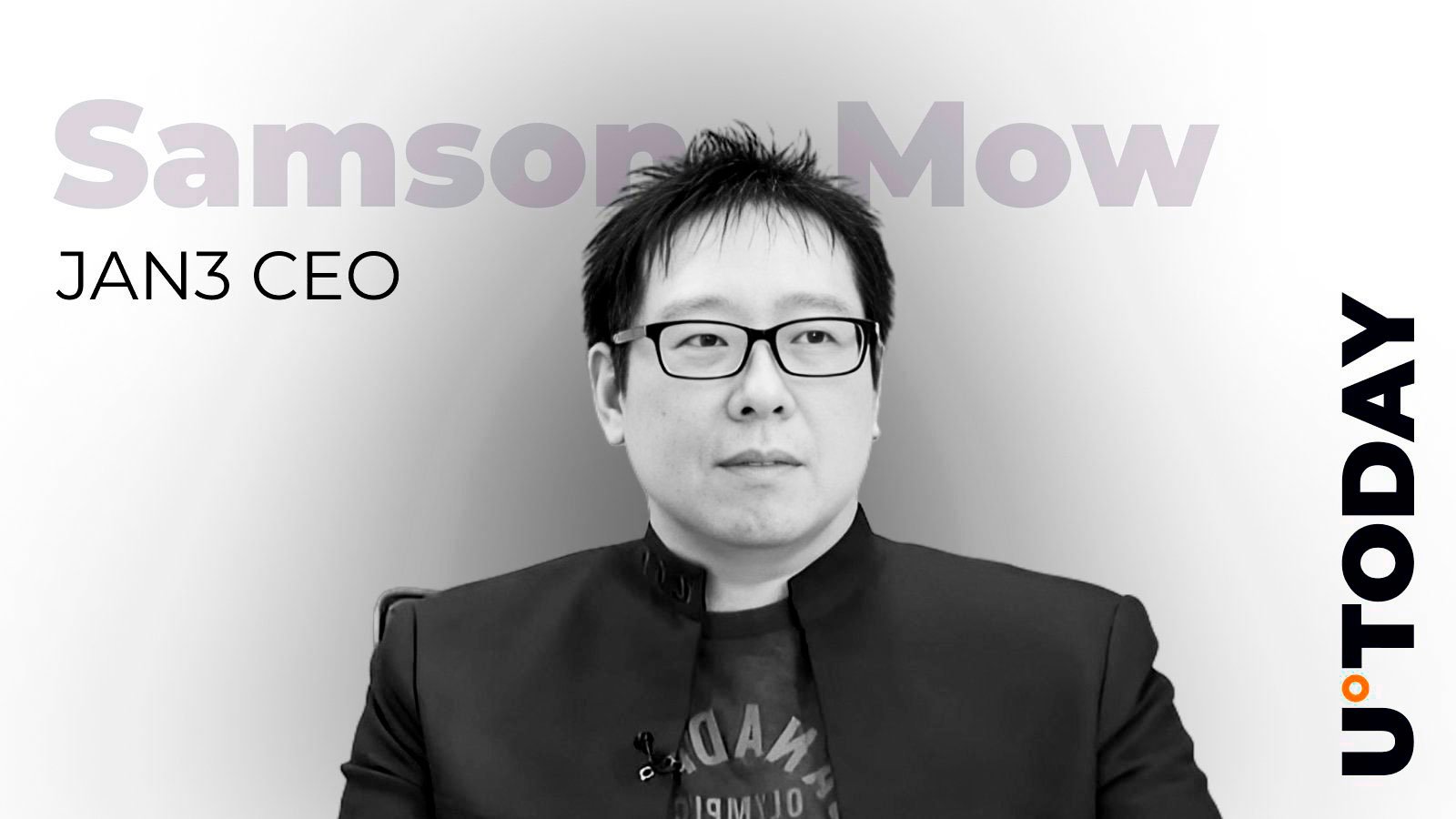

Zcash developer Mow advises ZEC holders to purchase Bitcoin instead

Prominent Zcash developer Mow advises ZEC holders to shift to Bitcoin, reflecting potential concerns about altcoin viability amid Bitcoin’s dominance and market consolidation trends.

-

Trump praises cryptocurrency in significant political recognition for digital assets

The endorsement signals political validation for digital assets, potentially influencing regulatory approaches and mainstream adoption as cryptocurrencies gain recognition from influential figures.

-

Market inactivity presents strategic opportunities for attentive investors during quiet periods

Market stability during periods of inactivity often signals underlying strength or consolidation, providing strategic opportunities for investors to assess long-term trends without noise.

-

Ray Dalio warns Federal Reserve stimulus is feeding late-stage economic decay

Ray Dalio warns that Federal Reserve stimulus measures are contributing to late-stage economic decay, highlighting concerns about unsustainable monetary policies and their long-term market implications.

-

Question posed about cryptocurrency exchange performance in 2025

The source poses a speculative question about future exchange performance without providing analysis, data, or specific entities to evaluate market implications.

-

Standard Chartered Crypto Guru Advises Buying Bitcoin Immediately to Avoid Missing Out

Standard Chartered’s crypto expert advises immediate Bitcoin purchase, reflecting institutional urgency and potential market timing concerns amid volatile cryptocurrency adoption phases.

-

Trump praises cryptocurrency for easing burden on the US dollar

Trump’s endorsement of cryptocurrency for reducing dollar dependency may paradoxically undermine Bitcoin by increasing regulatory scrutiny and competition from alternative digital assets.