Category: Memecoins

-

Analyst Who Puts Dogecoin Price At $10 Reveals The Trend That Will Drive The Surge | Bitcoinist.com

Analyst Dima James Potts predicts Dogecoin could surge to $10, citing a recurring logarithmic arc pattern and Bitcoin’s potential new all-time high as key drivers for this bullish rally.

-

Dogecoin down 30%, mirrors 2021 structure: Prepare for a potential…

Dogecoin (DOGE) is down 30% but mirrors past cycles that preceded major rallies. Analysts note similarities to 2017 and 2021 patterns, suggesting potential accumulation and future breakout despite current market conditions.

-

65% Of Shiba Inu Holders Suffer Massive Losses As Curse Of June Takes Hold | Bitcoinist.com

65% of Shiba Inu holders face losses as June’s bearish trend continues, with SHIB historically performing poorly this month. Some predictions suggest a potential rebound soon.

-

Pump.fun bets $4B on PUMP: Golden opportunity or a high-risk setup?

Pump.fun plans a $4B PUMP token launch amid rapid growth, raising concerns over retail investor risks and high valuation despite strong protocol revenue and potential buyback mechanisms.

-

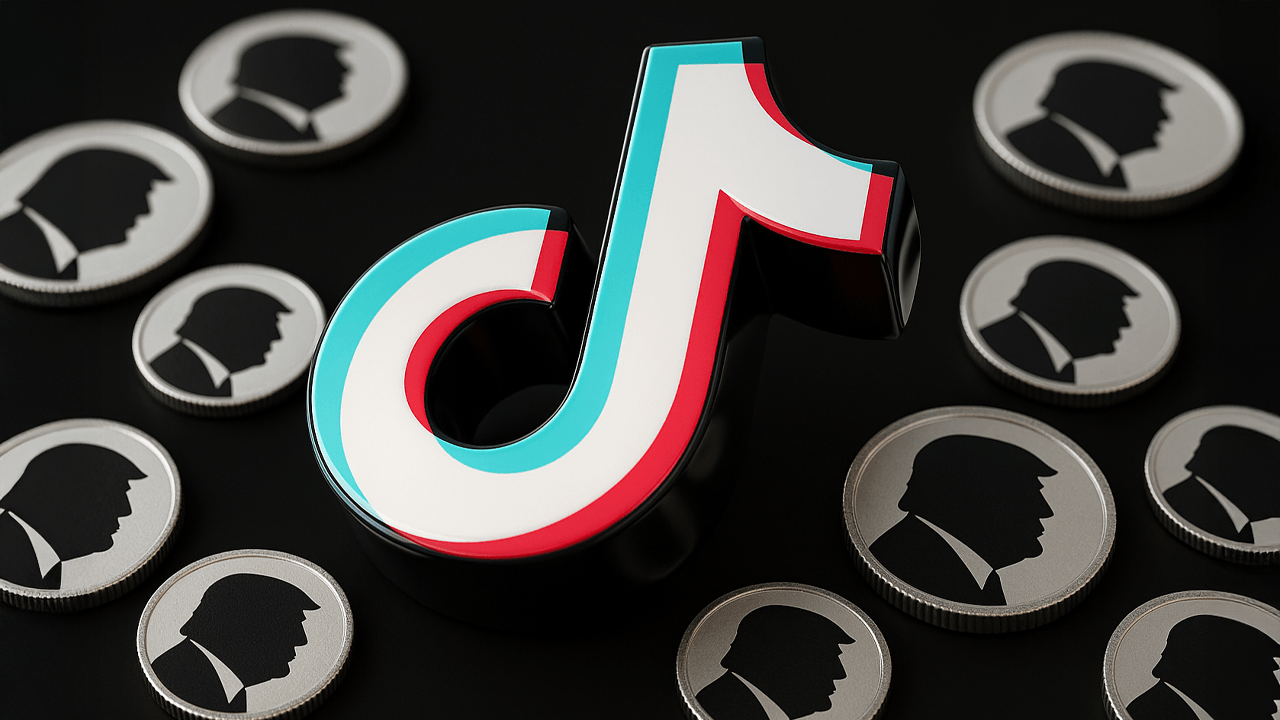

TikTok Fires Back: No TRUMP Coin Buys, Despite Congressman’s Claims

TikTok denies claims by Congressman Brad Sherman that its Chinese owners bought $300M in TRUMP memecoin, calling the allegations false. The controversy ties into TikTok’s US ban delay and broader crypto-political debates.

-

Pepe Price Prediction: Rare MVRV Signal Just Flashed

Pepe price (PEPE) has dropped 3.3% amid meme coin downturn. On-chain metrics show whales exiting, with 7% fewer ‘in the money’ wallets and declining large transactions. MVRV Z-score signals potential capitulation.

-

Analyst Says To Expect Dogecoin Price At $5 This Cycle | Bitcoinist.com

A crypto analyst predicts Dogecoin could reach $5 this cycle, citing historical symmetrical triangle patterns leading to past breakouts. The $5 target would give DOGE a $720B market cap.

-

Tiktok Fires Back at $300M Trump Coin Allegation: ‘Irresponsible and False’ – Crypto News Bitcoin News

Tiktok denies U.S. Rep. Brad Sherman’s allegations of purchasing $300M in TRUMP memecoins, calling the claims ‘patently false’ and irresponsible.

-

Dogecoin Price Action Mirrors the Historic 2021 Pump Setup

Dogecoin’s price action resembles its 2021 breakout pattern, with analysts noting a double-bottom reversal and key support at $0.168, potentially signaling a rally amid ETF filings and market optimism.

-

WEPE Pumps 84% as Markets Shaken, Pepe Stays Green

WEPE surged 84% amid market turmoil, driven by strong community support and potential Bitfinex listing. Its Alpha Chat and QuestN campaigns have boosted engagement and profits.