Category: Market Analysis

-

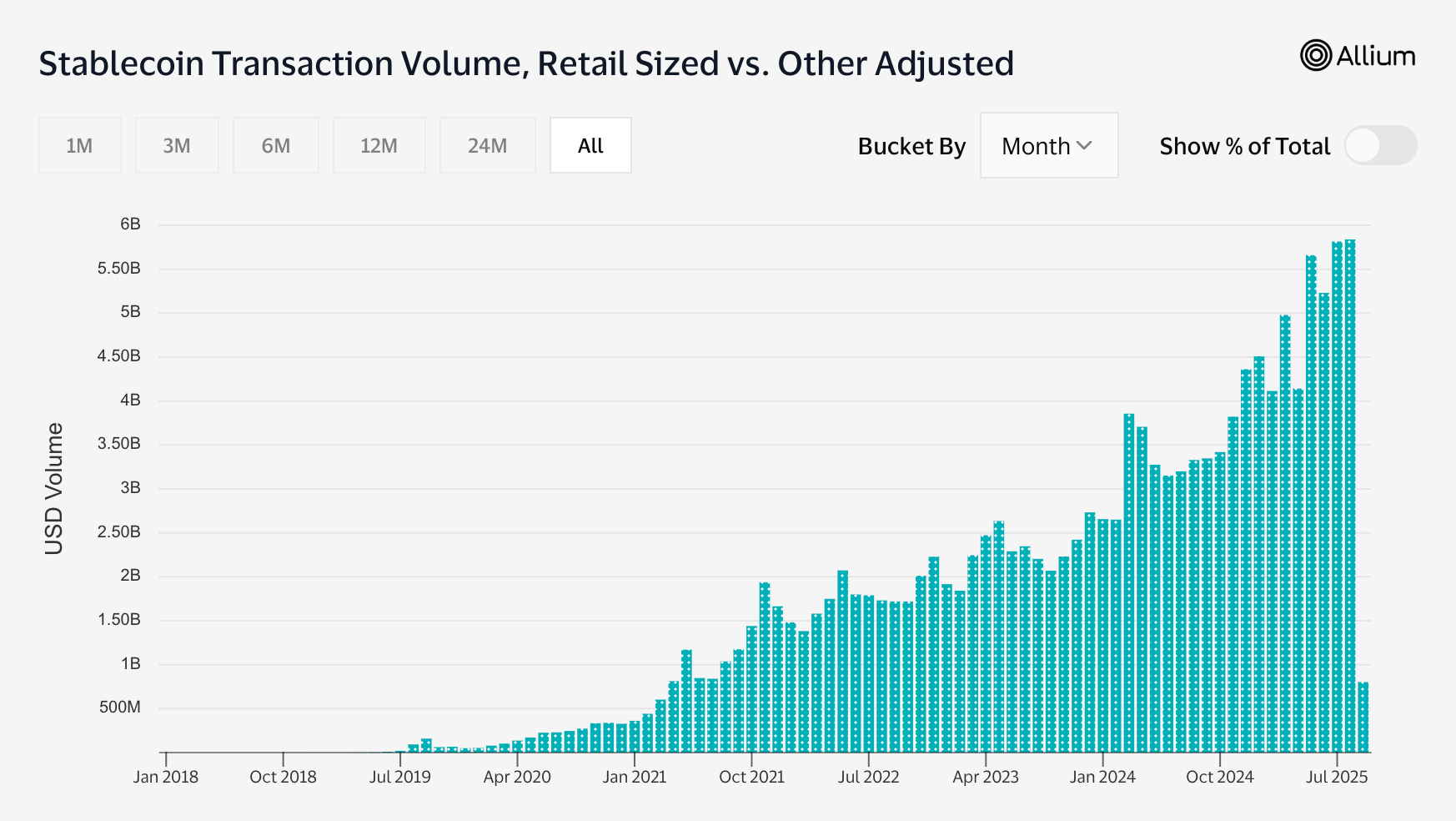

Stablecoin Retail Transfers Reach Record Level with BSC and Ethereum Gains

Stablecoin retail transfers reached a record level with BSC and Ethereum gaining ground while Tron experienced a decline in market share.

-

Bitcoin has a logical bounce zone at $100,000

Bitcoin has a logical bounce zone at $100,000 according to the source.

-

DOGE Price Prediction for September 7 Based on Market Analysis

DOGE price prediction for September 7 is provided based on current market analysis and trends.

-

XRP runs out of chances versus Bitcoin

XRP has no more opportunities to compete against Bitcoin according to the source.

-

El Salvador buys gold and USDT gains crude settlement use in Venezuela

El Salvador purchased gold and USDT rose as a crude settlement tool in Venezuela, according to Latam Insights.

-

AI bigger cryptocurrency winner between XRP and ADA for 2025

AI predicts which cryptocurrency between XRP and ADA will have bigger price gains in 2025, with a surprising conclusion about the outcome.

-

Binance Coin BNB Price Prediction for September 7 Analysis

Binance Coin BNB price prediction for September 7 is discussed without specific price targets or numeric forecasts.

-

Ethereum mirrors Bitcoin post ATH movement with bears targeting correction

Ethereum mirrors Bitcoin’s post-ATH movement as market bears target a 20% correction for both cryptocurrencies.

-

Chainlink LINK pullback to $16 set up parabolic rally

Chainlink LINK may pull back to $16, potentially setting up a parabolic price rally according to analysis.

-

El Salvador Adds 14,000 Troy Ounces of Gold After Bitcoin Accumulation Pause, Total Holdings Hit $207M

El Salvador adds 14,000 troy ounces of gold after Bitcoin pause, total holdings reach $207 million.