Category: DeFi & DApps

-

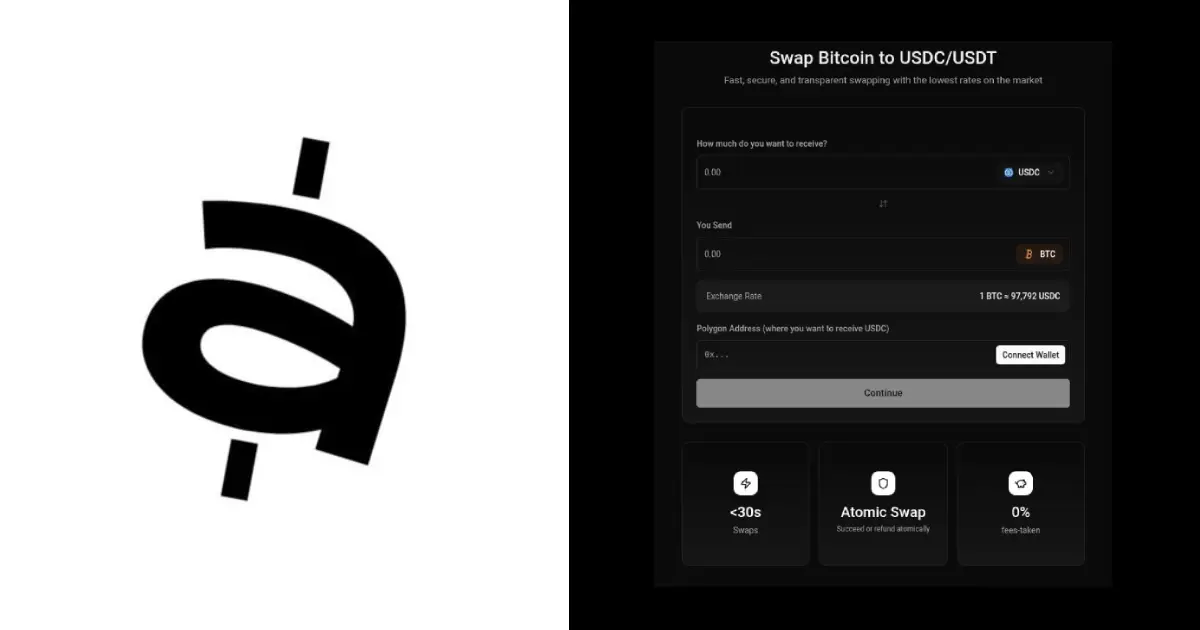

Non-custodial cross blockchain exchange supports Bitcoin and stablecoins trading

This exchange enables direct peer-to-peer trading across blockchains without third-party custody, reducing counterparty risk and advancing decentralized finance interoperability for major digital assets.

-

OKX launches decentralized exchange trading in US and global markets

OKX expands decentralized exchange access globally including the US, increasing DeFi adoption and providing users with non-custodial trading alternatives in regulated markets.

-

Hyperliquid tokenized equity market activity increases amid blockchain expansion

The tokenized equity market on Hyperliquid is experiencing increased activity, reflecting growing institutional interest in blockchain-based traditional asset representation and market evolution.

-

Threshold upgrades tBTC bridge for institutional Bitcoin DeFi access

Threshold’s upgrade enhances institutional Bitcoin DeFi access by improving the tBTC bridge, increasing security and interoperability for traditional finance participants entering decentralized finance.

-

OKX enables direct DEX trading for all wallet users

OKX now allows all wallet users to trade directly on decentralized exchanges, enhancing accessibility and interoperability across the crypto ecosystem without intermediaries.

-

Dromos Labs reveals Aero after merging two major Layer 2 DEXs

Dromos Labs created Aero by merging two major Layer 2 decentralized exchanges, enhancing scalability and liquidity in the DeFi ecosystem through unified trading infrastructure.

-

SharpLink increases Ethereum treasury allocation for DeFi yield enhancement

SharpLink is increasing its Ethereum holdings to pursue higher returns through DeFi protocols, reflecting corporate treasury diversification strategies into crypto yield opportunities.

-

Wrapped Bitcoin launches on Hedera network expanding Bitcoin DeFi access

This integration enables Bitcoin holders to access Hedera’s DeFi ecosystem, increasing BTC utility and liquidity while bridging leading blockchain networks for expanded functionality.

-

DYDX governance approves 75 percent protocol fee allocation for token buybacks

The dYdX governance community approved allocating 75% of protocol fees to token buybacks, enhancing tokenomics by reducing supply and rewarding long-term holders through deflationary mechanisms.

-

Ethereum DeFi security now rivals traditional banks according to Buterin

Vitalik Buterin asserts Ethereum’s DeFi security now rivals traditional banks, signaling maturity in decentralized finance infrastructure and potential mainstream financial system competition.