Category: Crypto Crunch

-

Crypto markets decline during US regional bank stress and government shutdown

Cryptocurrency markets declined due to US regional banking instability and extended government shutdown, reflecting sensitivity to traditional financial stress and political uncertainty.

-

Bitcoin drops 13 percent as altcoins decline amid geopolitical meetings

Bitcoin declined 13% amid geopolitical tensions involving global leaders, with altcoins also experiencing significant losses during the market downturn.

-

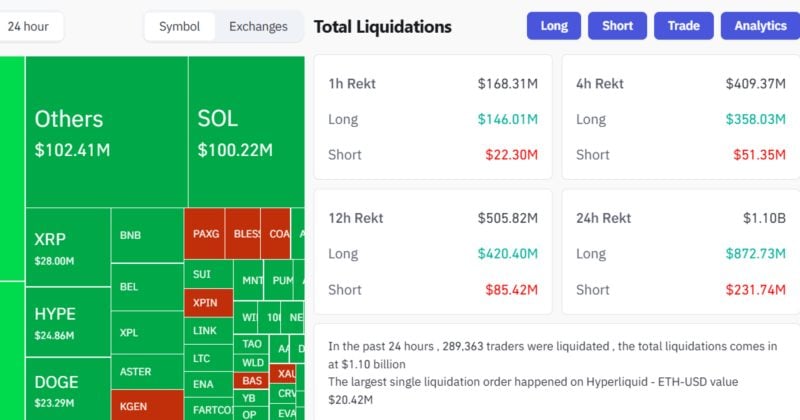

Crypto liquidations $1.2 billion amid market volatility

The cryptocurrency market experienced significant liquidations totaling over $1.2 billion, reflecting heightened volatility and potential market stress as traders adjust positions amid price swings.

-

Trump says China tariffs will not stand during cryptocurrency market decline

The statement reflects ongoing trade tensions impacting global markets, with cryptocurrency volatility often correlating with geopolitical uncertainty and investor risk aversion.

-

Bitcoin tumbles following $1.18 billion in cryptocurrency liquidations across markets

Large-scale liquidations totaling $1.18 billion triggered significant Bitcoin price declines, reflecting market volatility and heightened leverage risks across cryptocurrency trading platforms.

-

Crypto market cap falls by $230 billion as Fear Index hits April lows

The crypto market’s $230 billion decline reflects heightened investor anxiety as the Fear Index reaches April lows, signaling potential volatility and risk aversion in digital assets.

-

Crypto market cap falls by $230 billion as Fear Index hits April lows

The crypto market’s $230 billion decline reflects heightened investor anxiety as the Fear Index reaches April lows, signaling potential volatility and risk aversion in digital assets.

-

Crypto market cap drops to $3.5 trillion amid fear index rise and ETF outflows

The crypto market cap decline to $3.5 trillion reflects deepening ETF outflows and heightened fear levels, indicating institutional caution and potential short-term volatility.

-

Bitcoin drops below $105,000 with over $1 billion liquidated from crypto markets

The $1 billion liquidation reflects extreme market volatility and leverage unwinding, highlighting systemic risks in crypto trading during sharp price corrections.

-

Over $1 billion in liquidations occurred during Bitcoin and altcoin market decline

Massive liquidations totaling over $1 billion occurred as Bitcoin and altcoins experienced significant price declines, indicating severe market volatility and leveraged position unwinding across cryptocurrency markets.