Category: Crypto Crunch

-

Turkey cryptocurrency trading volume quadruples United Arab Emirates in 2025

Turkey’s cryptocurrency trading volume significantly surpassed the UAE in 2025, reflecting regional economic trends and increased adoption in emerging markets according to Chainalysis data.

-

US cryptocurrency transactions exceed $1 trillion in first half of 2025

US cryptocurrency transaction volume reached $1 trillion in H1 2025, reflecting accelerating adoption and institutional participation in digital asset markets.

-

Counter-Strike 2 Skins Market Loses $1.784 Billion in 24 Hours

The Counter-Strike 2 skins market experienced a $1.784 billion loss in 24 hours, highlighting volatility in digital asset markets comparable to cryptocurrency meme coins.

-

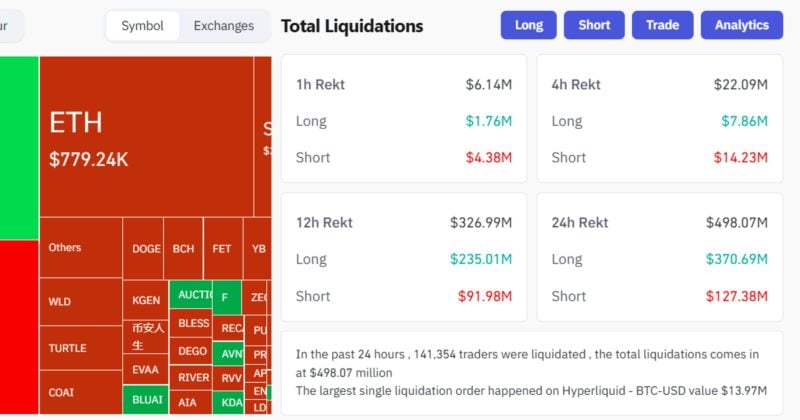

Crypto market records $371 million in long position liquidations over 24 hours

This liquidation event reflects market volatility and leverage risks, potentially indicating trader overconfidence or rapid price shifts affecting cryptocurrency derivatives markets.

-

Cryptocurrency declines amid Federal Reserve conference and Coinbase acquisition

Cryptocurrency markets declined while the Federal Reserve held a digital assets conference and Coinbase acquired Echo, reflecting regulatory scrutiny and industry consolidation trends.

-

Crypto market sees over $160 million in short liquidations in past hour

Massive short liquidations indicate extreme market volatility and forced position closures, reflecting heightened leverage risks and potential trend reversals in cryptocurrency trading.

-

AWS outage locks traders out of Coinbase and Robinhood platforms

The AWS outage disrupted major trading platforms, highlighting cryptocurrency’s infrastructure vulnerabilities and dependence on centralized cloud services during market volatility.

-

Altcoin selling pressure continues as exchange inflow hits 2025 high

High altcoin exchange inflows indicate persistent selling pressure, reflecting market uncertainty and potential price volatility as investors move assets to exchanges for liquidation.

-

Crypto liquidations reach $1.2 billion amid Bitcoin and Ethereum price declines

The $1.2 billion liquidation event reflects extreme market volatility and leverage unwinding, impacting trader positions and highlighting systemic risks in cryptocurrency derivatives markets.

-

Over one billion dollars liquidated as Bitcoin and altcoins plunge in market meltdown

Massive liquidations reflect extreme market volatility and leverage unwinding, signaling potential risk reassessment across cryptocurrency portfolios as traders face margin calls.