Category: Crypto Crunch

-

Stolen funds increase to $116.6 million according to recent reports

This significant loss highlights ongoing security vulnerabilities in crypto platforms, requiring enhanced protective measures to maintain investor trust and market stability.

-

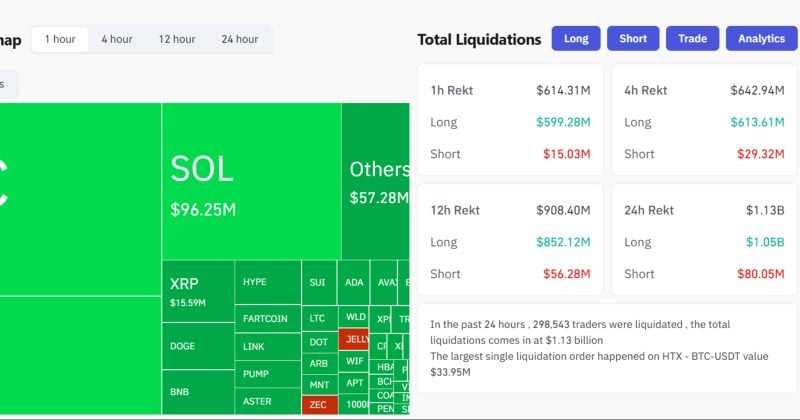

Crypto markets face potential systemic risks following record liquidation day

The record liquidation event creates systemic risk concerns for crypto markets, potentially triggering cascading liquidations and exposing vulnerabilities in leveraged trading infrastructure.

-

Bitcoin mining profitability slumps with hashprice at multi-month low

Bitcoin mining profitability declines as hashprice drops to multi-month lows, impacting miner revenues and potentially forcing operational adjustments amid changing network conditions.

-

Cryptocurrency liquidations hit $1.33 billion during Bitcoin Ethereum XRP Dogecoin volatility

Extreme volatility across major cryptocurrencies triggered massive leveraged position liquidations, highlighting market fragility and risks of high-leverage trading during price swings.

-

Traders lose over one billion dollars in twenty four hours as longs get crushed

Leveraged long positions faced massive liquidations as Bitcoin’s sharp price drop triggered cascading margin calls across major exchanges, highlighting crypto market volatility risks.

-

Binance deposits drop 80 percent amid market changes

Binance experienced an 80% decline in deposits, reflecting market volatility and potential investor concerns about exchange stability amid regulatory scrutiny and competitive pressures.

-

Bitcoin Ethereum XRP prices plunge as liquidations exceed $1.1 billion

Major cryptocurrencies including Bitcoin, Ethereum, and XRP experienced significant price declines, with over $1.1 billion in liquidations indicating severe market stress and leveraged position unwinding.

-

Bitcoin Ethereum Dogecoin plunge amid crypto liquidations exceeding $1.1 billion

Major cryptocurrencies experienced sharp declines as leveraged positions were forcibly closed, indicating heightened market volatility and potential overexposure among traders.

-

Six hundred million dollars in cryptocurrency long positions liquidated in one hour

Massive long position liquidations indicate extreme market volatility and potential trend reversals, creating cascading sell pressure across cryptocurrency derivatives markets.

-

Ethena USDe market cap declines 40 percent after October 10 Black Friday

The 40% market cap decline for Ethena USDe following the October 10 crash reflects significant volatility in algorithmic stablecoins, highlighting liquidity risks during market stress events.