Category: Crypto Crunch

-

$98k breakdown sparks market cascade not seen since

The $98k price breakdown triggered a market cascade resembling May’s volatility, indicating potential liquidity issues and heightened trader caution in current conditions.

-

Hyperliquid experiences $30 million manipulation tied to POPCAT token

A $30 million market manipulation event on Hyperliquid involving POPCAT highlights vulnerabilities in decentralized exchanges and risks for meme coin investors.

-

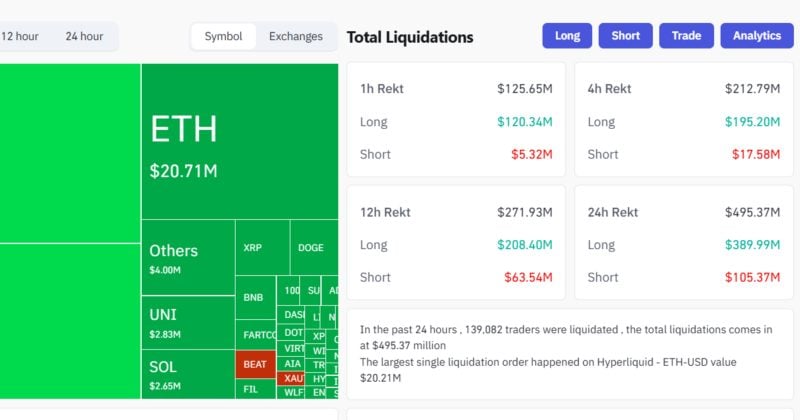

Bitcoin falls below $103K causing $120 million long liquidations in one hour

The $120 million liquidation event reflects extreme market volatility and leverage unwinding, indicating heightened risk for traders during rapid Bitcoin price movements below key levels.

-

Bitcoin user pays over $105000 in fees for a $10 transfer

This incident highlights Bitcoin’s scalability challenges and unpredictable fee volatility, demonstrating why high transaction costs remain a barrier for everyday cryptocurrency payments.

-

Crypto funds lose $1.17 billion following October liquidity shock

Crypto funds experienced significant outflows following October’s liquidity shock, reflecting investor caution amid market volatility and reduced institutional confidence in digital assets.

-

Digital investment products face $1.17 billion in outflows this week

Digital investment products experienced significant capital withdrawals totaling $1.17 billion, reflecting shifting investor sentiment and potential market volatility in cryptocurrency and blockchain sectors.

-

Crypto ETPs record $1.2 billion outflows with assets dropping to $207.5 billion

Crypto ETPs experienced significant capital withdrawals totaling $1.2 billion, reducing assets under management to $207.5 billion amid market volatility and shifting investor sentiment.

-

Bitcoin reaches $106000 triggering 341 million dollar liquidation across crypto markets

The $341 million liquidation event reflects extreme market volatility as Bitcoin’s price surge triggers mass position closures, highlighting ongoing risk in leveraged cryptocurrency trading.

-

Key US funding rate suddenly collapses indicating cheaper cash and higher risk

The SOFR’s unexpected drop signals potential liquidity stress in financial markets, increasing counterparty risk and affecting derivatives pricing while reflecting underlying funding market volatility.

-

Yield-bearing stablecoins face investor exodus after three tokens fail

Investors are fleeing yield-bearing stablecoins following three token collapses, highlighting systemic risks in algorithmic models and raising concerns about DeFi sector stability.